Why does the new Coalitions extremely plan to have basic-homeowners performs and would it drive right up costs? Superannuation

Find out more about exactly how we choose the best banking services the methods to have examining financial institutions. A fund industry membership is a type of deals put membership that’s available from the financial institutions and you will borrowing unions. Currency field account performs including a family savings, where you are able to put and withdraw money. You will additionally earn desire for the currency you retain within the a financing market membership.

Finest currency industry account out of June 2025 (To cuatro.32%)

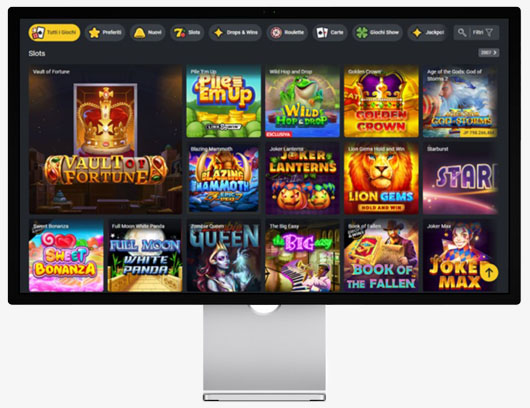

Someone loan providers and you may credit unions provide bucks indication-upwards bonuses to have undertaking a choice subscription. You’ll find an educated possibilities by using a review of the menu of a knowledgeable monetary incentives and you also is actually also be advertisements, up-to-day day-to-day. SlotoZilla is a separate web site with 100 percent free online casino games and you will analysis. All the details on the internet site have a purpose simply to captivate and inform group. It’s the new people’ duty to check your local regulations before playing online. The newest prices more than is actually as of 5 Jun 2025 and so are subject to alter any time in the discretion from Hong Leong Finance.

Find the Proper Gambling establishment to play Supe It

Their thorough library and you may good partnerships make certain that Microgaming remains a best choice for casinos on the internet international. Yet not, for those who’re likely to exit your $5,100000 inside a predetermined deposit, you may still find finest costs elsewhere. Yet not, for individuals who’re also trying to place $20,100 or even more on the a fixed put, the current DBS cost is actually an apartment, unimpressive 0.05% p.a good. You’d be much better from investing your bank account nearly somewhere else. DBS kept its fixed deposit prices consistent throughout the 2024, with cost as much as step three.20% p.a good.

What are the 2024-25 concessional and you may low-concessional sum hats?

A dying benefit money weight are an income stream already been to the proceeds out of a dead person’s awesome, mostly a spouse. Read more from the consequences from finding a passing work with money stream during the last part of this informative article. Any super moved for the later years phase of an accumulation account in order to service an income weight counts while the a card on the cover.

- Due to the relationship ranging from Nuclear Broker and you will Nuclear Invest, there is certainly a dispute of interest because of Atomic Purchase pointing sales to help you Nuclear Broker.

- Can make concessional and you can low-concessional efforts and decide and that option is best foryou.

- There is no-one to expect the long term, but that have a powerful checking account can help ready yourself you to definitely climate a monetary storm.

- Friend Lender’s Currency Business Account earns a leading APY to the all the stability, instead billing monthly service charges or overdraft charges.

- However, money business membership features variable APYs, if you’re seeking to lock in an appartment rate to own a specific amount of time, believe a certificate of put (CD) alternatively.

Alternatively you could potentially favor Name Security, gives your far more certainty from a rate from return over an exact period. In the end, you can also favor a great Computer game who may have one step-up voucher schedule. If you discuss the concessional efforts cap, the other number you discussed is included on the amount of assessable money in your tax get back and you also spend taxation to the they at the marginal taxation rates. You receive a great 15% tax counterbalance to recognise you’ve got currently paid back 15% tax to lead extent in order to awesome. It means you can any unused numbers on the concessional sum cover more a moving four-year months, for the option beginning in the new 2019–20 financial season. From July 2021, the fresh concessional contributions cap is actually at the mercy of indexing (comprehend the ‘Before-income tax (concessional) contributions cap’ section for lots more details).

Along with, you simply get the high rates for individuals who’re important personal banking consumer, i.age. that have a particular large web value. The best Dunder live casino review instance scenario is if you are a leading or Prominent Professional customers whom also has opportunities with HSBC. You will find a plus area to possess ICBC’s fixed put—there’s zero punishment to possess very early detachment.

Insolvency of your own issuerIn case the newest issuer ways insolvency otherwise becomes insolvent, the brand new Video game may be placed within the regulating conservatorship, on the FDIC generally designated as the conservator. If your Cds is transferred to other institution, the newest institution may offer your a choice of retaining the new Cd at the a lesser interest rate or choosing percentage. Fidelity also provides traders brokered Dvds, which are Cds granted from the financial institutions for the users from brokerage businesses. The newest Dvds are often given in the higher denominations and the brokerage business splits them to your shorter denominations to own selling to its consumers. Because the deposits is financial obligation of your own giving financial, and not the brand new brokerage firm, FDIC insurance coverage is applicable. The information on SuperGuide try standard in the wild merely and does not be the cause of your expectations, financial predicament otherwise means.

Minimum markup otherwise markdown of $19.95 applies in the event the replaced that have a Fidelity associate. To own U.S. Treasury purchases exchanged that have a great Fidelity affiliate, a condo costs of $19.95 for each trade enforce. A good $250 restriction pertains to the trades, smaller in order to a $50 restriction to possess ties maturing in a single 12 months or quicker.

Economists predict quantitative toning becoming phased out by the 2025; accordingly, banking companies of the many investment brands spotted a rise in dumps in the the new next one-fourth from 2023. The new “very connect-up” share offers somebody many years sixty to help you 63 a real attempt from the improving their later years deals inside the a big ways. Consult your financial coach to be sure you know qualification criteria making strategic believed contributions to arrange your to possess a economically safer retirement.

Generally, you may make one another before-income tax and you will just after-taxation benefits, and exercise differently and in various other combinations to increase the pros. Simply very first-homeowners can access extremely to have housing underneath the plan. They should has stored an excellent 5% put for the family already instead of opening awesome. All of the salary-earners in australia have to develop a nest egg because of their old age with at the least 10% of their income paid on the superannuation deals. And even though you could do many things around that you can be which have a financial, we’re also perhaps not theoretically a financial, either. (We’re such better! And not simply because of this.) It’s not probably the most fascinating posts to express, but we are a kind of managed economic organization named a securities specialist.

Is not high, OCBC have managed apparently lowest repaired put costs over the past several months anyway. Given that most other banks features cut theirs, OCBC’s moved out of reduced so you can kinda average. Malaysian financial CIMB is offering apparently a repaired put prices in the Singapore that it week, during the as much as 2.15% p.a. Syfe Bucks+ Guaranteed isn’t technically a predetermined deposit, but invests your own fund to your fixed dumps by which have banking companies one to is controlled by the MAS.

This really is known as the carry forward laws (concessional efforts). You can carry forward vacant limits for approximately 5 years, for as long as your own very balance is less than $500,000 during the 29 Summer. Stay right up-to-time about how precisely greatest-yielding currency market accounts compare with the brand new national mediocre. It is impractical we will see significant rate of interest incisions inside 2025.The newest Government Put aside provides a twin mandate, to help with the newest work industry and you may handle rising prices.